Warren Buffett believes that wealth is built not by chasing shortcuts but by avoiding costly money mistakes. From overborrowing and reckless spending to choosing wrong investments, ignoring an emergency fund, and falling for get-rich-quick schemes — Buffett warns against these traps that can ruin financial health.

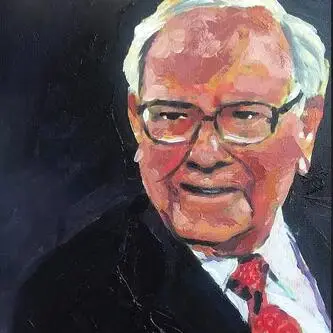

Warren Buffett’s golden rules: Never fall into these 5 money traps (Image: AI generated)

Warren Buffett, the greatest investor the world has ever seen, has proved that big wealth can be generated and sustained only when the right decisions are backed by patience. Buffett has always advocated keeping things simple when it comes to investing. “Richness doesn’t come from complex tricks, it comes from avoiding stupid mistakes,” says the legend, who is currently the chairman and CEO of the multi-billion-dollar conglomerate Berkshire Hathaway.

Even today, millions around the world take inspiration from Buffett’s words. He has repeatedly said that saving money and investing it in the right place is a much bigger challenge than earning it. In his view, most people fail in their investment journey because they get caught in ‘money traps,’ i.e., mistakes related to money.

Let us understand Warren Buffett’s five golden rules that can save you from these money traps.

1. Overborrowing

- One of Warren Buffett’s key teachings is — never take on more debt than you can handle. He says debt is like a snowball that starts small but gradually becomes so big that it becomes difficult to stop.

Unreasonable use of credit cards, expensive EMIs, and showing off by taking loans are some of the traps in which people often get caught. A recent report by the Reserve Bank of India stated that unsecured personal loans and credit card dues have increased very rapidly.

In a country like India, credit cards charge interest rates of up to 40% annually. Imagine if someone borrows money on their credit card and is being charged this interest — what would the borrower’s condition be?

Warren Buffett believes that debt not only wipes out your savings but also takes away your mental peace. His famous saying is — “If you are smart, you don’t need leverage. If you are dumb, it will ruin you.”

2. Spending on things you don’t need

- In our society, people often increase their expenses as their income increases. Buying expensive cars, luxury holidays, and branded things may make us look rich, but it does not make us rich. Warren Buffett himself is the biggest example of this. Despite being a multi-billionaire, he still lives in the same simple house he bought in 1958 and drives a 2014 Cadillac XTS with hail damage.

Warren Buffett says, “If you buy things you don’t need, you will soon sell things you need.” That is, in the process of buying things that are not needed, one day you may have to sell the things you need.

3. Choosing the wrong investment option

Investing in haste after seeing a boom in the stock market, buying trending stocks without research or falling into the trap of short-term profits – all these are dangerous money traps in Warren Buffett’s opinion. He has always said that patience is the biggest weapon in the world of investing.

Buffett’s famous rule is – “Never invest in a business you don’t understand.”

Today when people invest on the basis of social media ‘tips’ and ‘rumors’, this lesson is even more important. Thousands of investors suffer losses because they look for shortcuts to get rich quickly instead of following fundamental principles.

4. Not creating an emergency fund

- Buffett believes that life is uncertain and an economic crisis can come at any time. Losing a job, getting sick, or any other sudden expense can force you to take a loan if you don’t have an emergency fund and you may fall into a financial trap.

The recent COVID-19 pandemic brought to light just how important an emergency fund is. Millions of people have had to exhaust their savings or take loans because they had not prepared in advance.

On saving and creating an emergency fund, Buffet’s famous rule is – “Do not save what is left after spending, instead spend what is left after saving.”

One of the most practical money habits is to build an emergency fund. Most experts and financial planners suggest setting aside at least six months of living expenses in a liquid and easily accessible account. This way, even in times of crisis, you won’t have to rely on loans or credit cards.

5. Get-rich-quick trap

Buffett, who is also called the ‘Sage’ of Omaha, has repeatedly said that there is no shortcut to riches. Be it the stock market, real estate or any other sector, patience is the biggest mantra.

He always said the stock market takes money from those who keep trading frequently and gives it to patient investors.

(Only the headline and picture of this report may have been reworked by the ShareMantras staff; the rest of the content is auto-generated from a syndicated feed.)