The MAEE Formula: A Systematic Framework for Trading Any Market

Introduction: Cutting Through the Chaos of the Markets

For many new traders, the world of technical analysis can feel overwhelmingly complex. Charts are often cluttered with indicators, and price action can appear random. The solution to this chaos isn’t a secret indicator that predicts the future; it’s a disciplined, systematic methodology.

After years of analyzing market cycles and coaching traders, a consistent pattern emerges. The most successful market participants aren’t those reacting to every flicker on the screen, but those who execute a well-defined plan. This approach can be distilled into a powerful, four-step framework we call the MAEE Formula.

This is more than just theory. It’s a practical and robust strategy designed to help you pinpoint high-probability trading setups while enforcing strict risk management protocols.

Deconstructing the MAEE Trading Formula

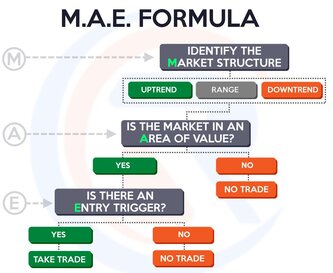

The acronym MAEE represents Market Structure, Area of Value, Entry Trigger, and Exit Strategy. This integrated framework guides you through the entire trading process—from initial market analysis to trade execution and risk management—ensuring no critical component is missed.

Let’s break down each element to understand how they combine to form a disciplined and powerful trading edge.

MAEE Formula

MAEE Formula Step 1: M – Market Structure (Identifying the Dominant Trend)

The first and most crucial step is to determine the prevailing trend. Who is in control: the bulls or the bears? Trading against the primary trend is like trying to swim against a powerful tide; it’s exhausting and rarely successful.

· Uptrend: Characterized by a sequence of consecutive higher highs and higher lows. Your bias should be toward seeking long (buy) opportunities.

· Downtrend: Defined by a series of consecutive lower highs and lower lows. Your bias should be toward seeking short (sell) opportunities.

By clearly defining the market structure, you instantly filter out 50% of the market’s noise. In a confirmed uptrend, you ignore sell signals. In a confirmed downtrend, you ignore buy signals. This simple discipline forces you to trade in the direction of the path of least resistance.

MAEE Formula Step 2: A – Area of Value (Your Strategic Entry Zone)

Just because a market is in an uptrend doesn’t mean you should buy at any price. Entering at the peak of a rally often leads to being trapped in an inevitable pullback. The objective is to enter the market at a strategic level where risk is minimized and potential reward is maximized—this is your Area of Value.

Think of this as waiting for a “discount” within the broader trend. Common Areas of Value include:

· Support Levels: (In an uptrend) A price zone where buying pressure has historically overwhelmed selling pressure, causing the price to bounce.

· Resistance Levels: (In a downtrend) A price zone where selling pressure has historically overwhelmed buying pressure. (A key concept: a broken resistance level often becomes a new support level, and vice versa).

· Key Moving Averages: Dynamic levels like the 50-period or 200-period EMA, which often act as support in uptrends and resistance in downtrends.

Entering a trade from a defined Area of Value provides your position with a logical foundation and a statistically superior chance of success.

MAEE Formula Step 3: E – Entry Trigger (The Confirmation Signal)

The market is in a clear uptrend and has pulled back to a key Area of Value. What next? You don’t simply enter a trade; you wait for confirmation. This is the role of the Entry Trigger—a specific, objective signal that indicates the resumption of control by the bulls (in an uptrend) or the bears (in a downtrend).

This step is what separates a strategic trader from a speculative gambler. Entry triggers eliminate emotion and subjectivity. Common examples include:

· Bullish/Bearish Candlestick Patterns: A bullish engulfing pattern, hammer, or piercing pattern in an uptrend; a bearish engulfing pattern, shooting star, or dark cloud cover in a downtrend.

· Price Action Breakout: The price convincingly breaking and closing above a recent minor swing high (in an uptrend) or below a recent minor swing low (in a downtrend).

The entry order is typically placed on the open of the candle immediately following the confirmed trigger.

MAEE Formula Step 4: E – Exit Strategy (Defining Risk and Reward Before Entry)

A trade setup is only complete once you have predefined your exit points before entering the position. This is the cornerstone of professional risk management. You must know precisely where you will exit for a loss if the trade fails and where you will take profits if it succeeds.

· Stop-Loss (Risk Management): This is a non-negotiable order that caps your potential loss. An effective technique is to place your stop-loss just beyond the recent swing high/low or one Average True Range (ATR) outside your Area of Value. The ATR is a volatility-based indicator that helps position your stop at a safe distance from normal market fluctuations.

·Take-Profit (Reward Strategy): Your profit-taking method should align with your trading style.

· Swing Trading: Aim to capture a single market swing, often exiting at the next predefined resistance (in an uptrend) or support (in a downtrend) level.

· Trend Following: Utilize a trailing stop-loss (e.g., based on a moving average or recent swing points) to remain in the trade as long as the trend persists, exiting only when the market structure shows definitive signs of reversal.

The MAEE Formula in Action: Practical Trading Scenarios

Let’s examine how this framework is applied in different market environments.

MAEE Formula Scenario 1: Forex Uptrend (EUR/USD)

· M (Market Structure): A clear uptrend is established with higher highs and higher lows.

· A (Area of Value): Price retraces and tests a prior resistance level that has now flipped to act as support.

· E (Entry Trigger): A prominent bullish engulfing candlestick pattern forms precisely at this support level.

· E (Exit Strategy): Stop-loss is set 1 ATR below the recent swing low. Take-profit is placed at the next significant resistance level, providing a favorable risk-to-reward ratio.

MAEE Formula Scenario 2: Stock Downtrend (Example: AAPL)

· M (Market Structure): A established downtrend is in place, marked by lower highs and lower lows.

· A (Area of Value): Price rallies up into a confluence zone containing the 50-period EMA and a previous support-turned-resistance area.

· E (Entry Trigger): A bearish engulfing pattern forms at this resistance confluence, confirming seller dominance.

· E (Exit Strategy): Stop-loss is placed 1 ATR above the entry candle’s high. A trailing stop-loss could then be employed to capture a prolonged downward move.

Why the MAEE Strategy is a Trader’s Most Valuable Tool

The true power of the M-A-E-E Formula lies in its adaptability and disciplined structure. It is not a rigid, black-box system.

· Adaptable: You can customize the tools for each step. Your Area of Value could be a Fibonacci retracement level or a volume profile node. Your Entry Trigger could be a momentum oscillator divergence.

· Universal: This principle-based framework is effective across all timeframes (from scalping to investing) and all liquid markets (forex, stocks, indices, and cryptocurrencies).

· Disciplined: It instills a process-oriented mindset, which is the hallmark of a professional trader. It also provides clear, rules-based filters for avoiding bad trades—if any one of the four components is missing, you have no valid reason to be in the market.

Only the headline and picture of this report may have been reworked by the ShareMantras staff; the rest of the content is auto-generated from a syndicated feed.